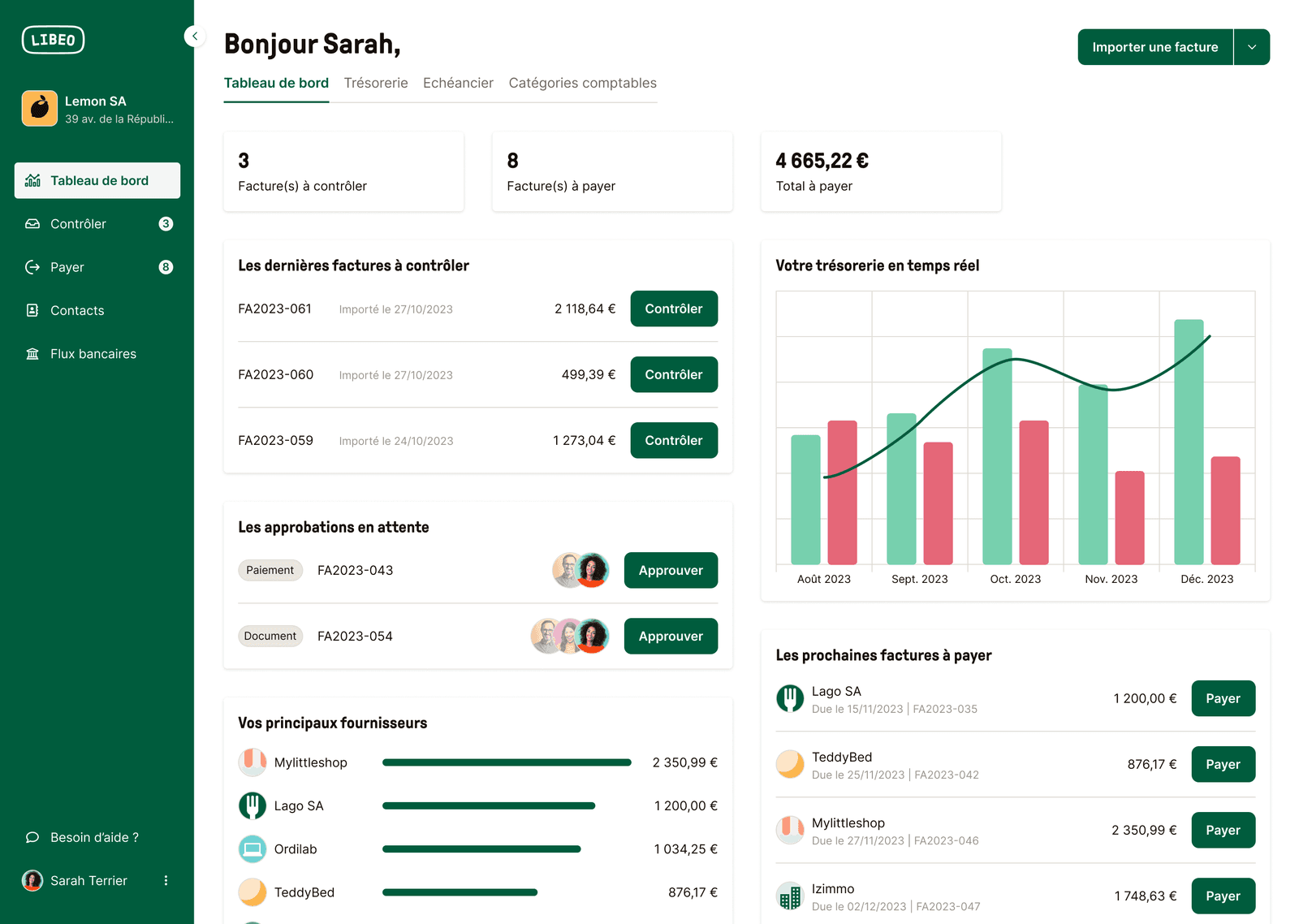

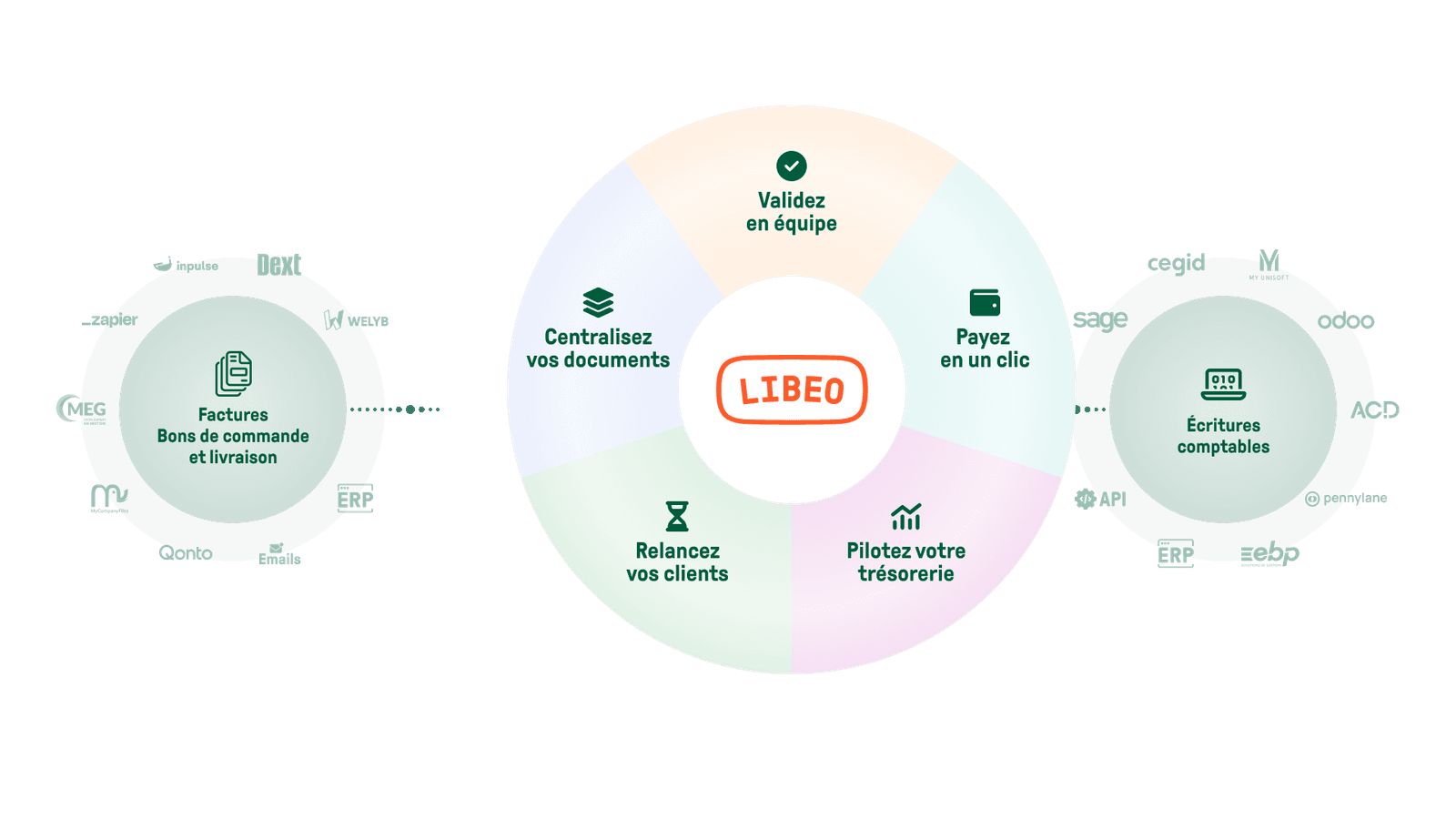

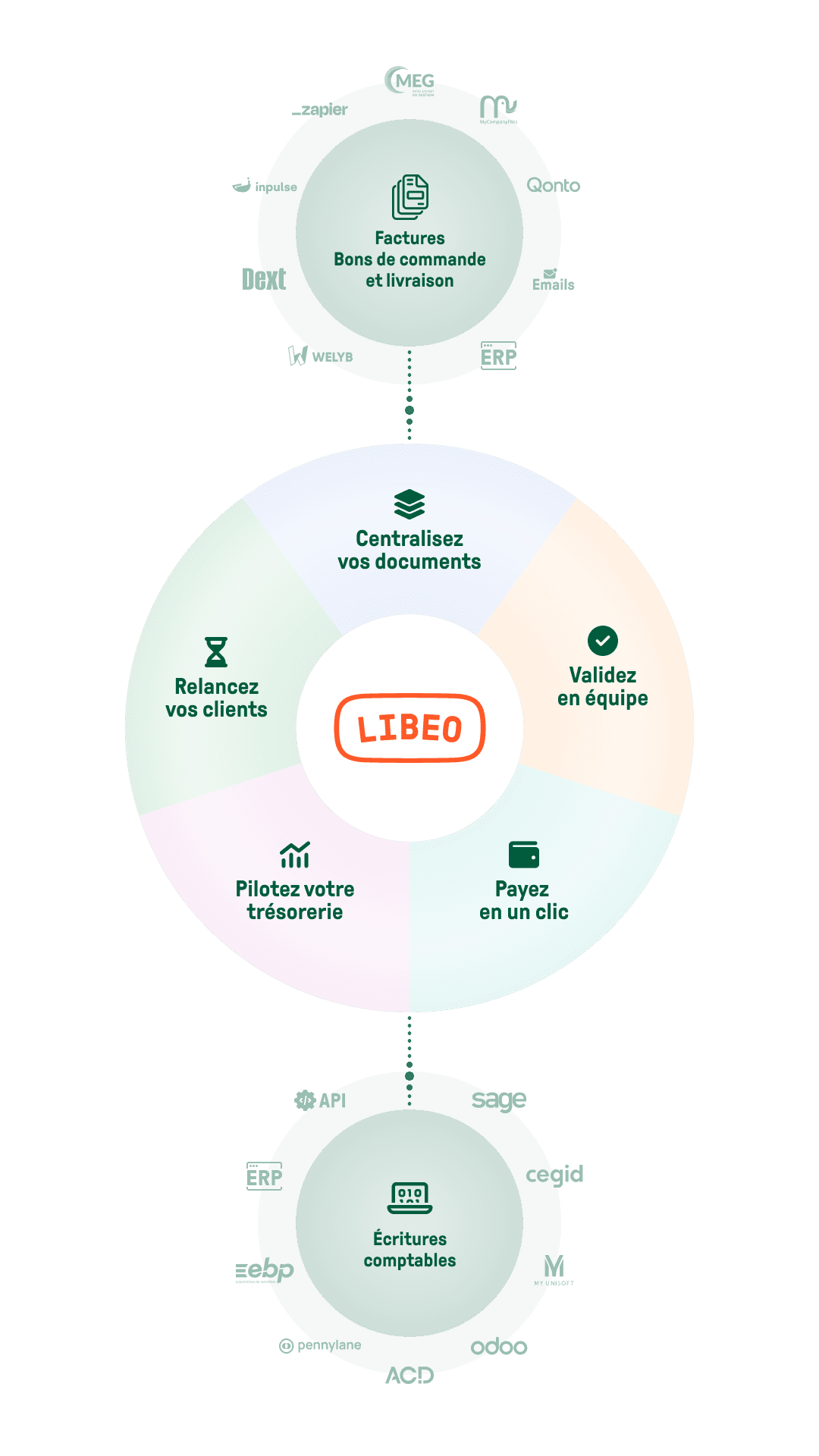

Payez et Encaissez vos factures en 1 clic

La solution pour centraliser, valider, payer ou vous faire payer, et piloter votre trésorerie efficacement.

Gagnez 5h par semaine dans votre gestion

Dites adieu à la saisie manuelle et aux Excel !

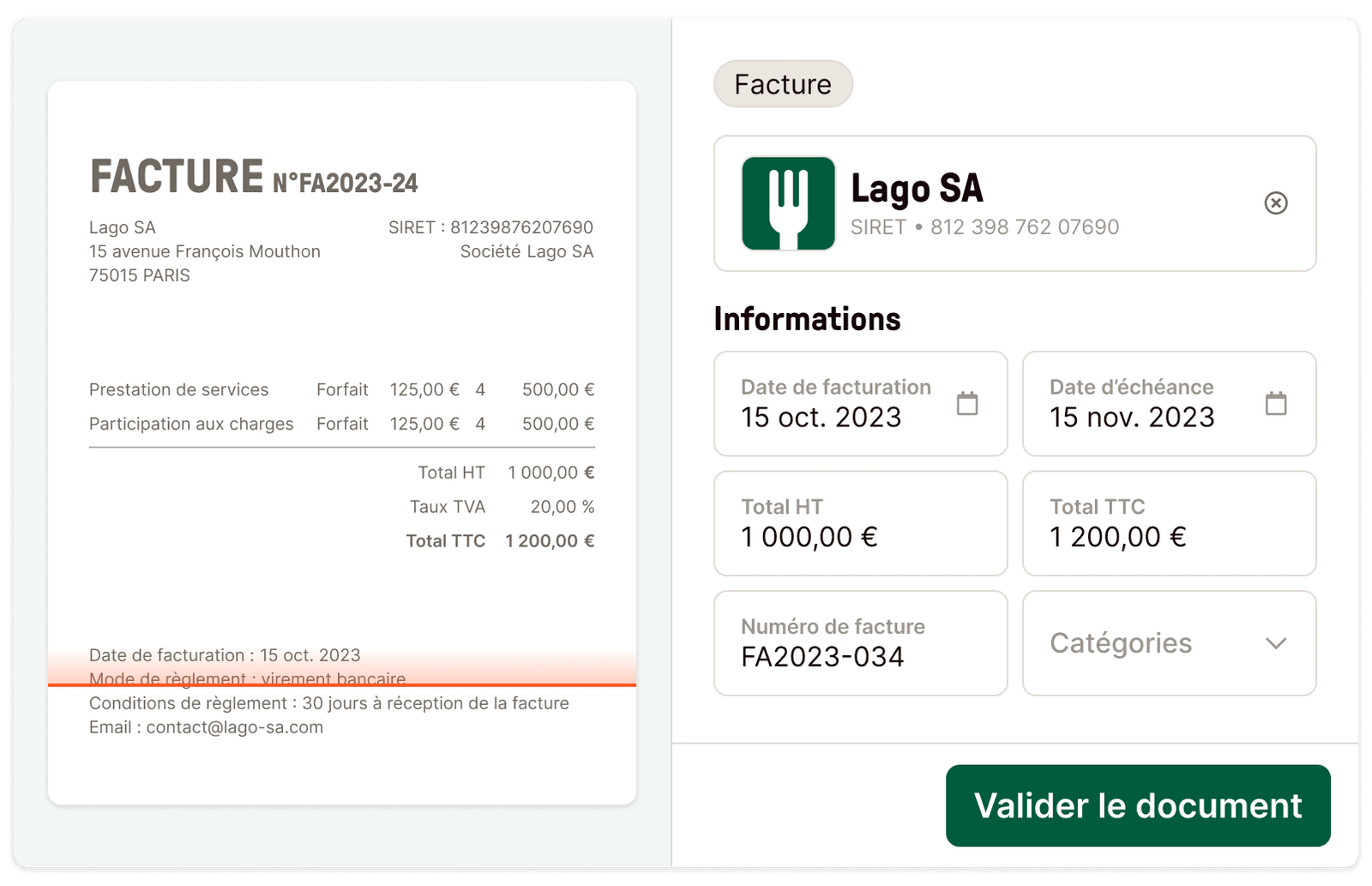

Centralisation

Gagnez du temps sur la collecte de documents

Centralisez toutes vos factures et bons de commande au même endroit, et partagez-les en temps réel avec votre expert-comptable.

En savoir plus

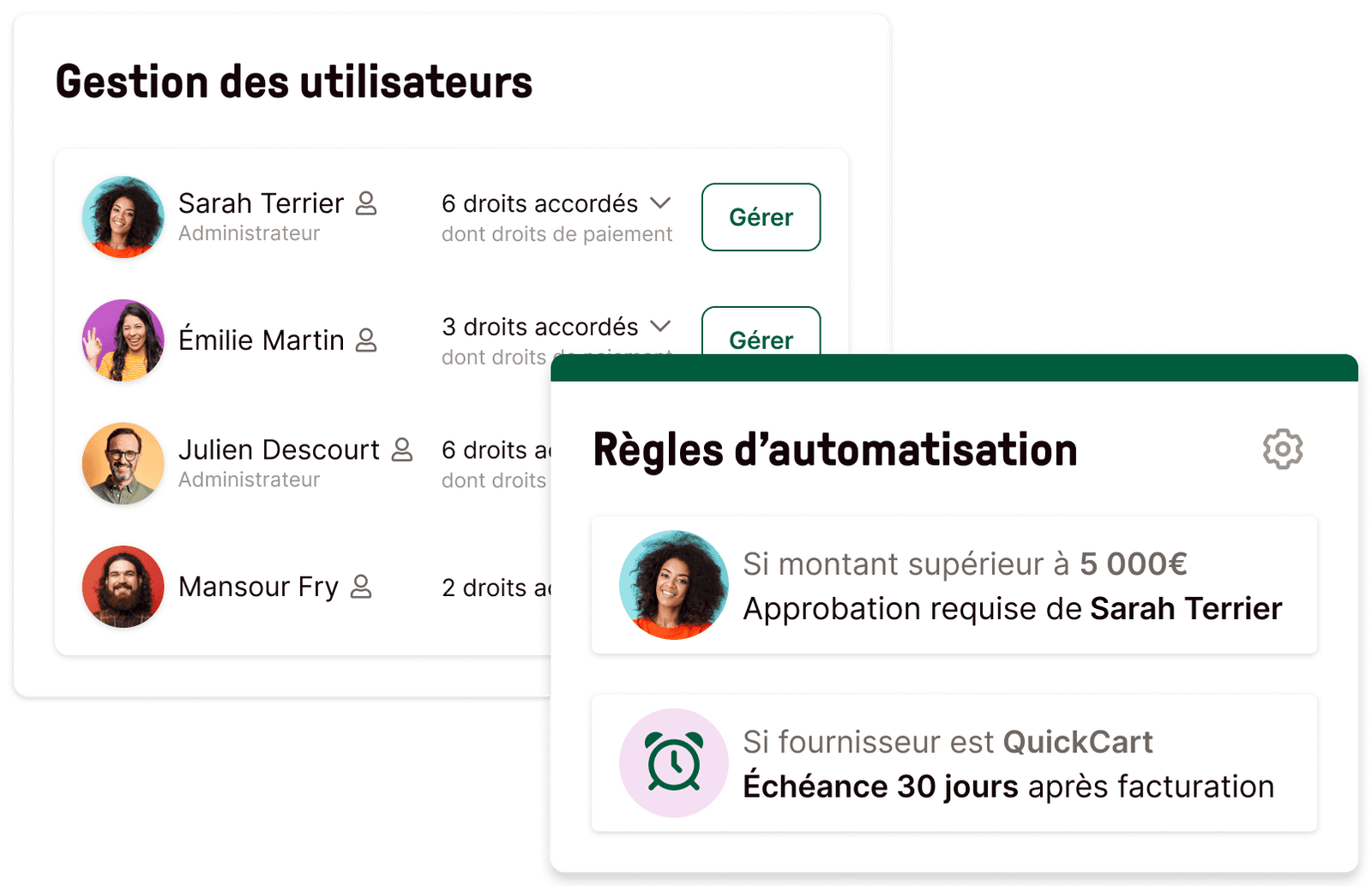

Workflows d'approbation

Contrôlez vos dépenses en équipe

Définissez vos circuits de validation, personnalisez vos règles d’automatisation et maîtrisez enfin toutes vos dépenses.

En savoir plus

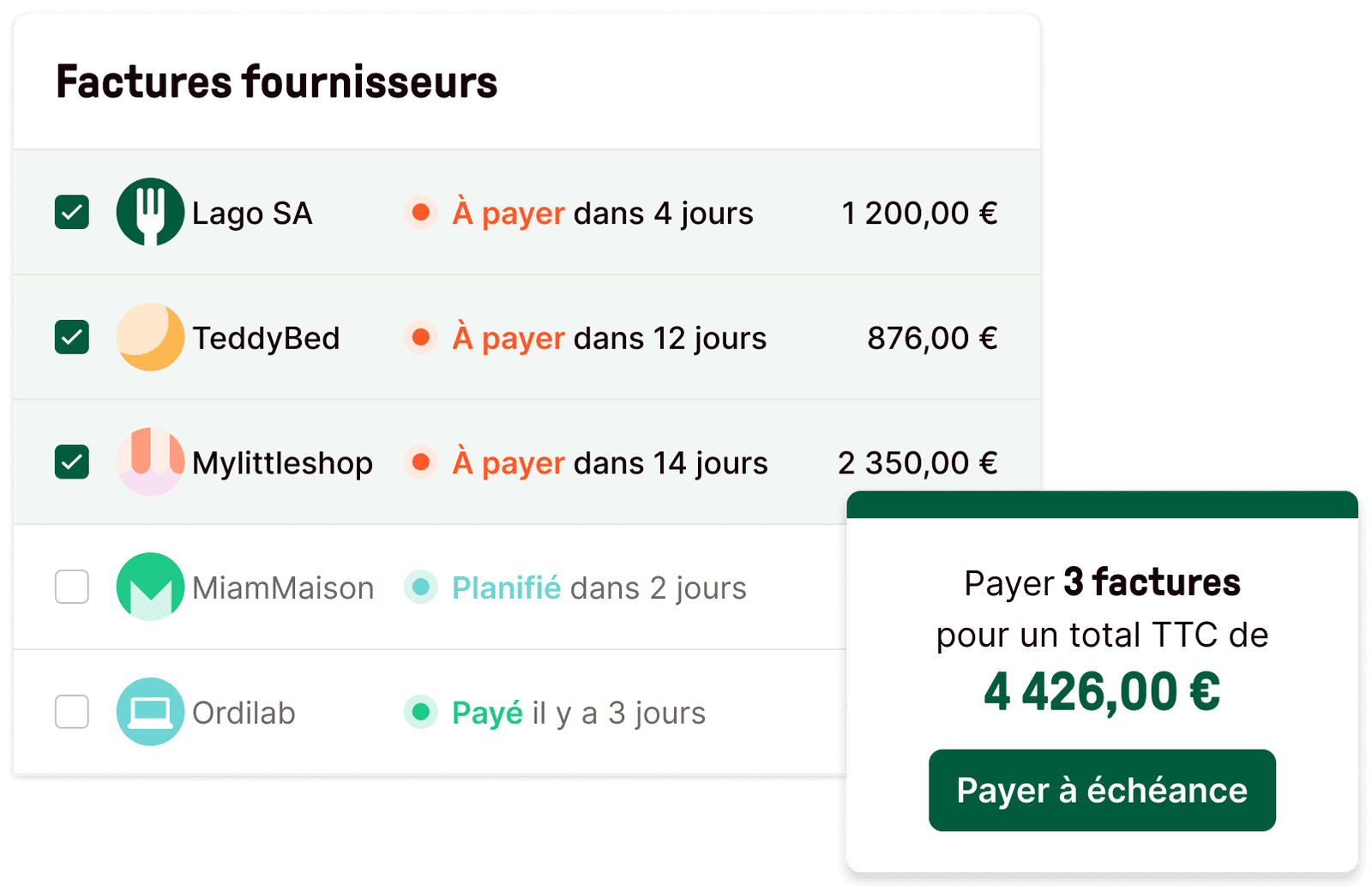

Paiement

Payez en un clic tous vos fournisseurs

Programmez vos paiements à la date de votre choix et exécutez-les depuis votre espace Libeo, sans passer par votre portail bancaire.

En savoir plus

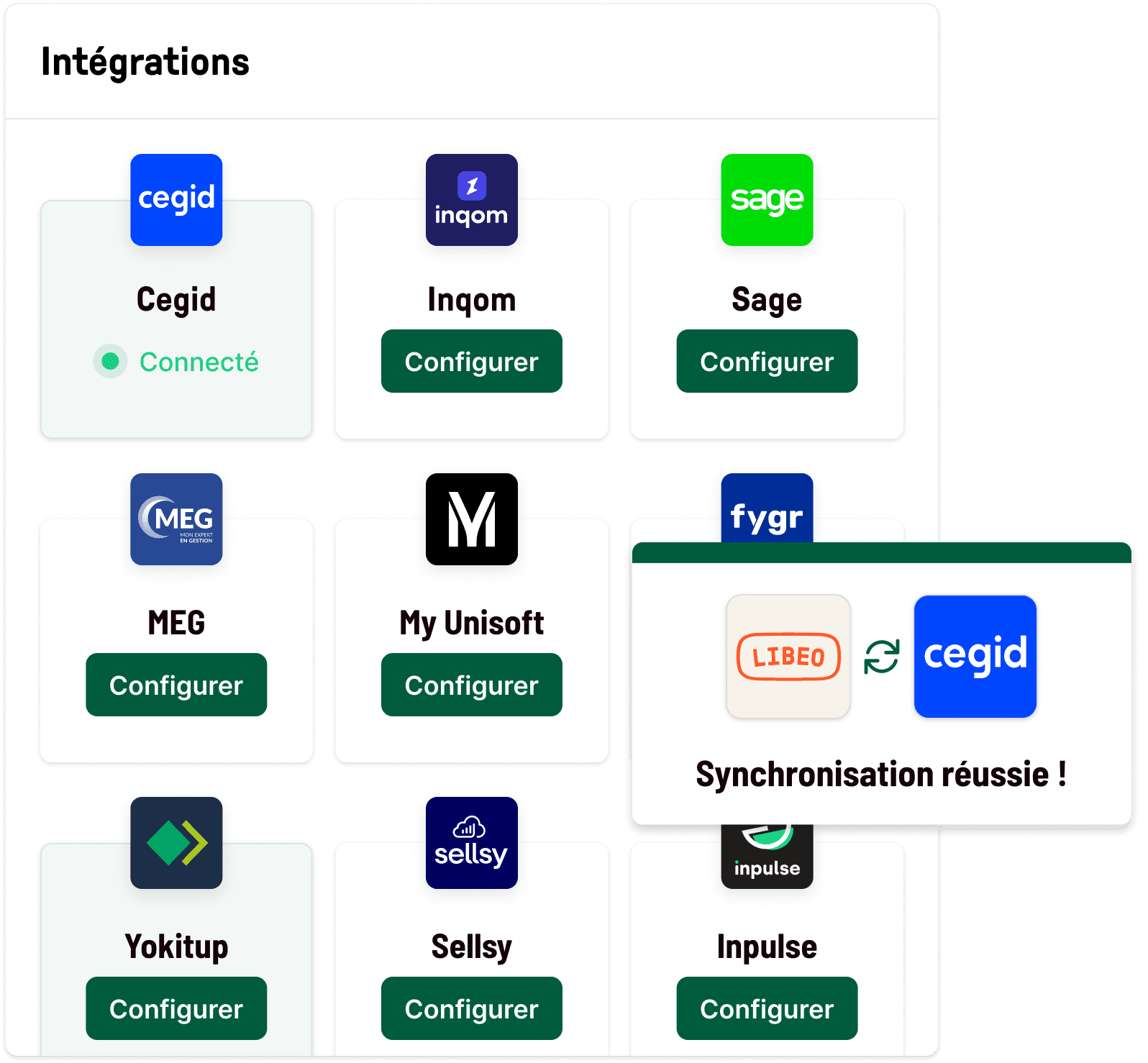

Intégrations

Récupérez et envoyez vos documents, automatiquement

Récupérez vos documents depuis votre logiciel comptable ou votre outil de gestion des stocks, et envoyez vos données vers l'outil de votre expert-comptable, sans qu'il ait besoin de vous solliciter.

En savoir plus

Finie la course aux encaissements

NouveauFAITES-VOUS ENFIN PAYER RAPIDEMENT

Personnalisez vos relances clients automatiques, faites-vous payer et recouvrez si besoin !

Essayer gratuitementRejoignez Libeo et ses 400 000 entreprises

Des entreprises de toute taille utilisent chaque jour Libeo

TPE & PME

Optez pour l'efficacité d'un seul outil pour la gestion des achats et de leur pré-comptabilité.

Groupes & franchises

Facilitez la gestion de toutes vos entités grâce à des vues consolidées sur leurs flux financiers.

Experts-comptables

Connectez Libeo à vos outils de production comptable et offrez à vos clients la meilleure solution pour gérer leur poste fournisseurs.

Sans Libeo, Côté Sushi n'aurait pas été en mesure d'assumer le développement qu’il a connu ces dernières années. Aujourd'hui, ce sont plus de 20 millions d'euros qui transitent par Libeo chaque année.

Emmanuel Taïb

CEO

Il me suffit d'appuyer sur un bouton pour tout valider : l'ensemble de mes factures sont réglées en un clic.

Marcel Nakam

Directeur Général

J’ai vu un changement d’organisation drastique : mon propre reporting sort plus vite et de meilleure qualité. Au moins c’était clair : on va aider les gens à mieux payer.

Caroline Soubils

Experte-comptable

Libeo nous permet de centraliser et contrôler facilement nos factures. Nos circuits de validation sont automatisés et sécurisés.

Elise Erbs

CFO

On avait du mal à suivre les paiements de nos factures. Il nous arrivait parfois de payer nos fournisseurs en double. Sans Libeo, on aurait jamais mis le doigt dessus.

Benjamin Cohen

Fondateur

Libeo est une solution gagnant-gagnant pour nos clients et pour nous. Elle permet de gagner du temps et mieux suivre nos clients au quotidien.

Rachel Chicheportiche

Collaboratrice comptable

Je ne comprends pas pourquoi tous les hôtels de France n'utilisent pas Libeo. J'en viens maintenant à intégrer tous les fournisseurs, même la quittance de loyer de mon hôtel.

François Dapremont

Propriétaire

Payer mes fournisseurs en 1 clic, ça m’a changé la vie.

Cécile Gracianette

Responsable Audit et Gestion

Aujourd'hui, je paie plus de la moitié de mes fournisseurs avec Libeo. Comme on a beaucoup de petits producteurs qui ne travaillent pas avec ce mécanisme de prélèvement, on les paie avec Libeo et c'est très apprécié.

Jean-Michel Roulet

Gérant

Sans Libeo, Côté Sushi n'aurait pas été en mesure d'assumer le développement qu’il a connu ces dernières années. Aujourd'hui, ce sont plus de 20 millions d'euros qui transitent par Libeo chaque année.

Emmanuel Taïb

CEO

Il me suffit d'appuyer sur un bouton pour tout valider : l'ensemble de mes factures sont réglées en un clic.

Marcel Nakam

Directeur Général

J’ai vu un changement d’organisation drastique : mon propre reporting sort plus vite et de meilleure qualité. Au moins c’était clair : on va aider les gens à mieux payer.

Caroline Soubils

Experte-comptable

Libeo nous permet de centraliser et contrôler facilement nos factures. Nos circuits de validation sont automatisés et sécurisés.

Elise Erbs

CFO

On avait du mal à suivre les paiements de nos factures. Il nous arrivait parfois de payer nos fournisseurs en double. Sans Libeo, on aurait jamais mis le doigt dessus.

Benjamin Cohen

Fondateur

Libeo est une solution gagnant-gagnant pour nos clients et pour nous. Elle permet de gagner du temps et mieux suivre nos clients au quotidien.

Rachel Chicheportiche

Collaboratrice comptable

Je ne comprends pas pourquoi tous les hôtels de France n'utilisent pas Libeo. J'en viens maintenant à intégrer tous les fournisseurs, même la quittance de loyer de mon hôtel.

François Dapremont

Propriétaire

Payer mes fournisseurs en 1 clic, ça m’a changé la vie.

Cécile Gracianette

Responsable Audit et Gestion

Aujourd'hui, je paie plus de la moitié de mes fournisseurs avec Libeo. Comme on a beaucoup de petits producteurs qui ne travaillent pas avec ce mécanisme de prélèvement, on les paie avec Libeo et c'est très apprécié.

Jean-Michel Roulet

Gérant

Les forces de Libeo

Service client personnalisé

Bénéficiez de l’accompagnement d’un chargé de compte dédié pour déployer Libeo.

Expérience de paiement unique

Libeo permet de payer les factures en un clic, à partir d’une simple adresse email, sans saisir d’IBAN ni avoir besoin de se connecter à sa banque.

Prise en main rapide

Libeo est la solution la plus ergonomique du marché qui vous permet d’être autonome en moins d’une demi-journée.

Lutte contre la fraude

Réglementée par l’ACPR, Libeo sécurise les transactions et réduit le risque de fraude et d’erreurs humaines.

Technologie robuste et éprouvée

Premier outil européen breveté pour le paiement fournisseurs, Libeo est disponible dans plus de 40 pays.

Aucune commission ni frais cachés

Votre abonnement s'adapte à votre usage, pour vous offrir le meilleur service, au meilleur prix.