Summary

Libeo, la solution de gestion

des dépenses pros

Automatisez vos règlements fournisseurs, contrôlez votre cash et optimisez enfin vos marges.

What is purchase-to-pay process?

Purchase-to-Pay (P2P) is a pivotal process in the supply chain. Also known as Procure-to-Pay, Purchase-to-Pay (P2P) is a computerised version of a company's purchasing process. It automates the entire purchasing lifecycle, from requisitioning to procurement to payment of supplier invoices. The supplier cycle is closely linked to Purchase-to-Pay. A P2P tool has different functionalities:

- Manage contracts (creation, renewal, negotiation, electronic signature...).

- Manage supplier relationships.

- Centralize electronic documents.

- Track and analyze expenses.

- Manage the purchasing process.

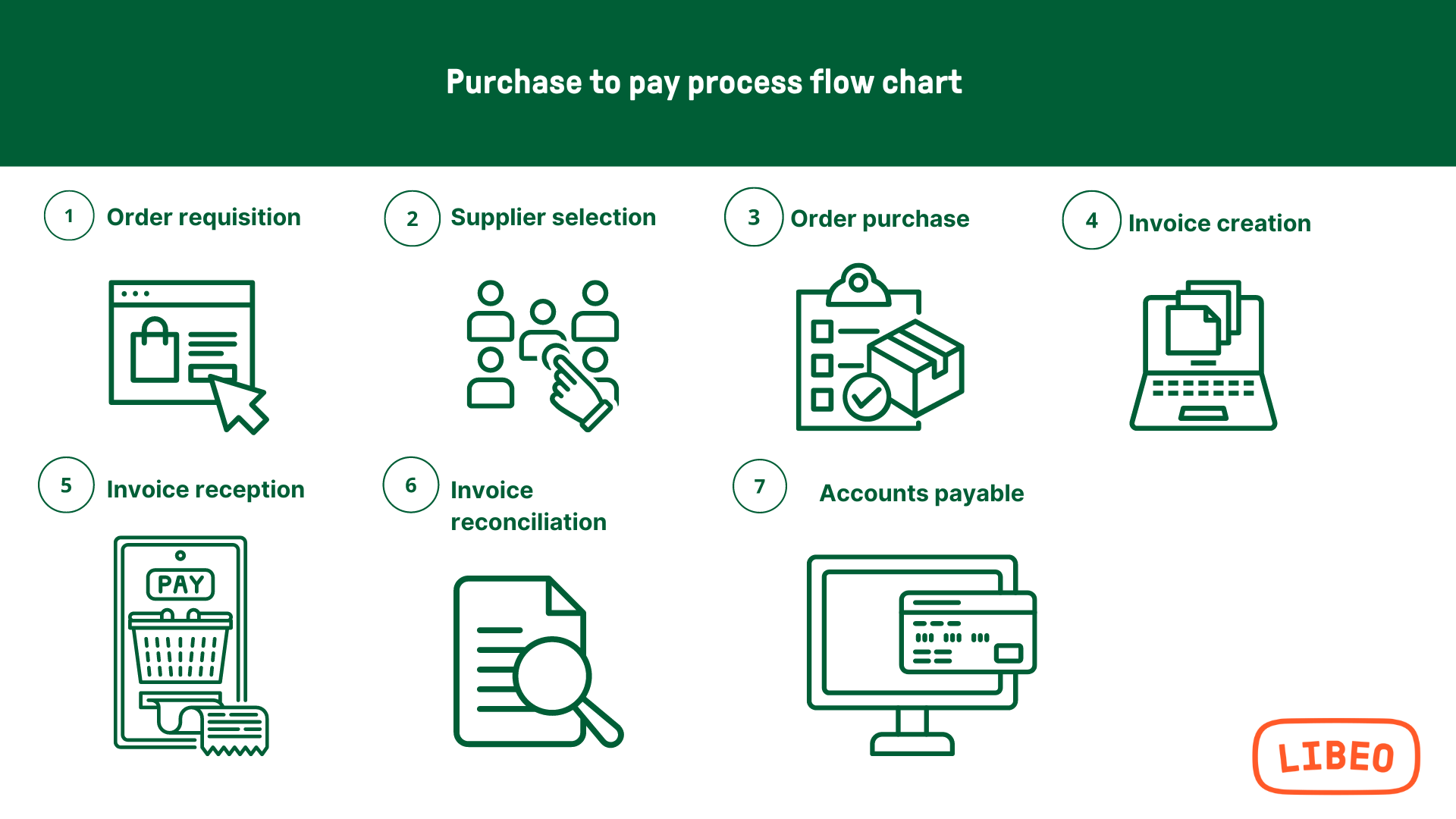

Procure-to-Pay steps: How does a P2P cycle work?

Not all companies have the same procurement process. Some may add procedures and sub-steps, or remove them. Nevertheless, most companies go through the following steps:

- Assessing the need.

- Procurement.

- Managing supplier invoices.

- Payment.

In the first stage, companies look for a product or service according to their budgetary constraints. They make a selection of suppliers capable of meeting their needs. This preliminary stage is called Source-to-Pay. By definition, it refers to the process that starts with sourcing suppliers and ends with the payment of orders.

Then they create their basket, go through a negotiation phase, make a purchase request by means of a purchase order which they send to suppliers and wait for processing.

In the second step, the purchase order is created. The goods are received and the order is evaluated to ensure that it conforms to the original request. To do this, the company must compare the purchase order with the goods receipt.

When the company receives the supplier invoice, it is reconciled with the purchase orders and validated internally. The invoice is then processed.

The company can proceed to the final phase of the purchasing process and make the payment of the invoice to the supplier. At the same time, it updates the supplier account.

Purchase to pay process flow chart

How much are you (actually) paying in accounts payable?

Calculate your invoice processing costs with our simulator and discover how much you could be gaining with Libeo.

CalculateFor CFOs - What is the value of P2P automation?

As a CFO, you know that a company’s success is directly linked to its ability to manage costs. As a result, you are always looking for ways to reduce expenses. One area where this can be done is through automating your Purchase-to-Pay (P2P) processes.

The value of P2P automation is clear: companies that have fully automated their P2P processes have seen significant improvements in cash flow management and overall efficiency. In fact, according to a recent survey by Capgemini, 39% of respondents reported that they saved more than 15% on invoice processing costs after automating their P2P processes.

Also: cost savings. P2P automation can reduce your organization’s spend by helping you find better prices for goods and services, as well as reduce invoice processing time by eliminating manual data entry and approval processes.

Why Finance Teams Are Choosing To Automate Their P2P Processes

Using a Procure-to-Pay tool frees up time for teams to focus on the most productive tasks. By automating the most basic functions, this solution helps to:

- Optimise the management of purchasing cycles to improve cash flow.

- Improve supplier relationships.

- Reduce the risk of error associated with manual invoice entry.

In concrete terms, a Purchase-to-Pay solution digitises, automates and optimises these various stages to enable companies to gain full control over their purchases and to improve efficiency. A Purchase-to-Pay solution supports the company's purchasing cycle from one end to the other. The final objective is to check that each step is carried out by the right person at the right time.

How To Automate Your Purchase To Pay Process in 3 steps

Purchasing is a critical process in any organization. If you are a small business or an entrepreneur, you probably have to handle your own purchasing.

- The first step is to obtain an electronic catalog of products that you buy regularly. This catalog can be created manually or automatically using a software program like E-catalog Builder.

- The second step is to create an electronic purchase order (or PO) template which will be used by everyone who needs to place an order with suppliers.

- The third step is to set up the automatic generation of purchase orders based on the items selected in the catalog. You could use Microsoft Excel for this task but it's better if you use specialized software which allows you to define rules for automatic creation of purchase orders based on product selection criteria such as supplier, item number, price range, etc.

Here are some factors you should consider when deciding which solution best fits your needs:

- Automated workflow: Create standard workflows for each of your purchase orders so that they follow the same path through your organization regardless of who creates them or where they're created. Adjust these workflows as necessary to accommodate any exceptions or changes in workflow policy over time.

- Integration with other systems: integrate your P2P solution with other systems such as accounting software to automate activities like invoice matching and approval. This means you'll spend less time manually entering data into other systems, which increases efficiency and decreases errors in data entry.

- Visibility into spend: with real-time reporting capabilities built into most modern solutions, it's easy to see how much money you're spending on what items at any given.

Embrace payment automation with Libeo

Pay easily, at the right time. Schedule your payments on time to free up your mind. Approve and pay invoices in seconds without entering your suppliers' bank account details or using your banking app.

Get a demoFAQ

What is the difference between purchase-to-pay and Procure to Pay?

Procurement is the process of finding, buying and managing suppliers. This includes sourcing products from vendors, negotiating pricing and terms with suppliers, arranging transportation and delivery of goods, managing returns and warranties, auditing accounts payable for accuracy, etc. Purchase-to-pay refers to the final step in this process: paying for orders once they've been received by your company.

What is an order to cash process?

An order to cash process is a workflow which allows you to convert your purchase orders into invoices. The purchase-to-pay process is part of an order to cash process but it doesn’t cover all parts of this overall process. It includes only what happens after an order has been created and before it reaches its final destination: paying for the product or service and receiving it from the supplier.

Is purchase-to-pay accounts payable?

Accounts Payable is also known as Procure to Pay. Accounts Payable consists in a series of processes involving the company's purchase and payments department and carrying out all necessary activities from placing an order to suppliers purchasing goods and making final payments to the suppliers.

What is a purchase to pay administrator's mission?

A purchase to pay administrator's job description can be resumed as the person in charge ofoverseing purchase order process including preparation, approval and matching. ·

Libeo, la solution de gestion

des dépenses pros

Automatisez vos règlements fournisseurs, contrôlez votre cash et optimisez enfin vos marges.