Libeo, la solution de gestion

des dépenses pros

Automatisez vos règlements fournisseurs, contrôlez votre cash et optimisez enfin vos marges.

What does KYS mean?

KYS: definition

"Know your supplier" (KYS), aka Know you Vendor, is a program that is being followed by many businesses. The main motive behind this program is to ensure that the quality and quantity of products purchased from suppliers are in line with their requirements. Suppliers, in business definition, are persons or organisations that provide a product or service to another entity

KYS meaning in business

The KYS program helps to increase productivity and bring down costs for businesses. The KYS program has four main components:

- Know your supply chain partners - Business leaders should know who their suppliers are and have an understanding of their business model, culture and values.

- Know what you buy - Business leaders should understand the products they use in their supply chain and the impact it has on society, the environment and human rights.

- Know what's happening in your supply chain - Business leaders must be able to track all transactions made between them and their suppliers as well as monitor issues that arise during these transactions such as accidents or injuries at work sites or environmental damage caused by pesticide use by farmers.

- Know how we can assist - Business leaders should seek out assistance from experts who can help them run a successful KYS program within their company.

This program has been implemented by companies all over the world.

Why have a KYS program?

The question can be formulated as follows: 'How do you know your suppliers well?'

The KYC program was designed to protect both the supplier and the buyer from fraudulent activities. The idea behind the program is that, when a business knows who they are dealing with, they can make better decisions regarding their interaction with that person or company.

Another reason why businesses should follow a KYS program is because it helps them avoid financial loss caused by bad debtors. When businesses do not know who they are doing business with, they cannot prevent their customers from running away without paying their bills or stealing their products.

The KYS program will allow you to:

- Reduce the time spent chasing your suppliers for unpaid invoices.

- Reduce the time spent managing late payment penalties.

- Improve cash flow as you will be paid quicker.

- Improve relations with suppliers, as you will avoid them getting upset about not being paid.

The equivalent exists between a company and its customers. This is known as Know Your Customer (KYC). Widely used in the banking sector, the KYC procedure enables the collection and updating of customer data. This is to ensure compliance with obligations to combat money laundering, fraud, tax evasion and the financing of terrorism. These two procedures (KYS and KYC) contribute to the management of third party risks.

How to assess your risk?

A good practice for any business would be to conduct an initial assessment of all new clients before signing a contract. This will help them understand what kind of business they are dealing with and whether they are likely to be involved in any illegal activities or transactions that could harm their reputation as well as their finances.

In the sourcing phase, start by creating an enquiry form to send to your potential suppliers. Whether you buy directly from the supplier or from their subcontractors, follow this procedure to ensure that you get the best possible value for money.

Know your supplier: checklist

- Research your supplier - before ordering goods, make sure you have researched the supplier. Where are the goods made? What standards do they meet? Are they certified as safe products? What materials have been used to make them? Can you visit the manufacturing facilities? Are there any online reviews of the company or its products?

- Place orders with several suppliers - if you have several suppliers, place small orders with each one first to test their service levels and compare prices before placing larger orders. If possible, try to place small orders with several suppliers to see who offers the best service levels over a period of time.

- Check products quality - What condition do they arrive in on delivery? What is the loss rate? Do they conform to the order (quantity, freshness, packaging, etc).

- Check payment terms - Does the supplier accept advance payments? Is the supplier flexible on payment terms? What is their position on paperless invoicing?

Managing your risk

Managing suppliers invoice payments is a big deal, especially in SMBs. Although the dematerialisation process can significantly reduce the risk of falsification, companies may still face risks.

This is why you need to know your suppliers and to have a good relationship with them. KYS is an essential step towards supplier management and risk mitigation.

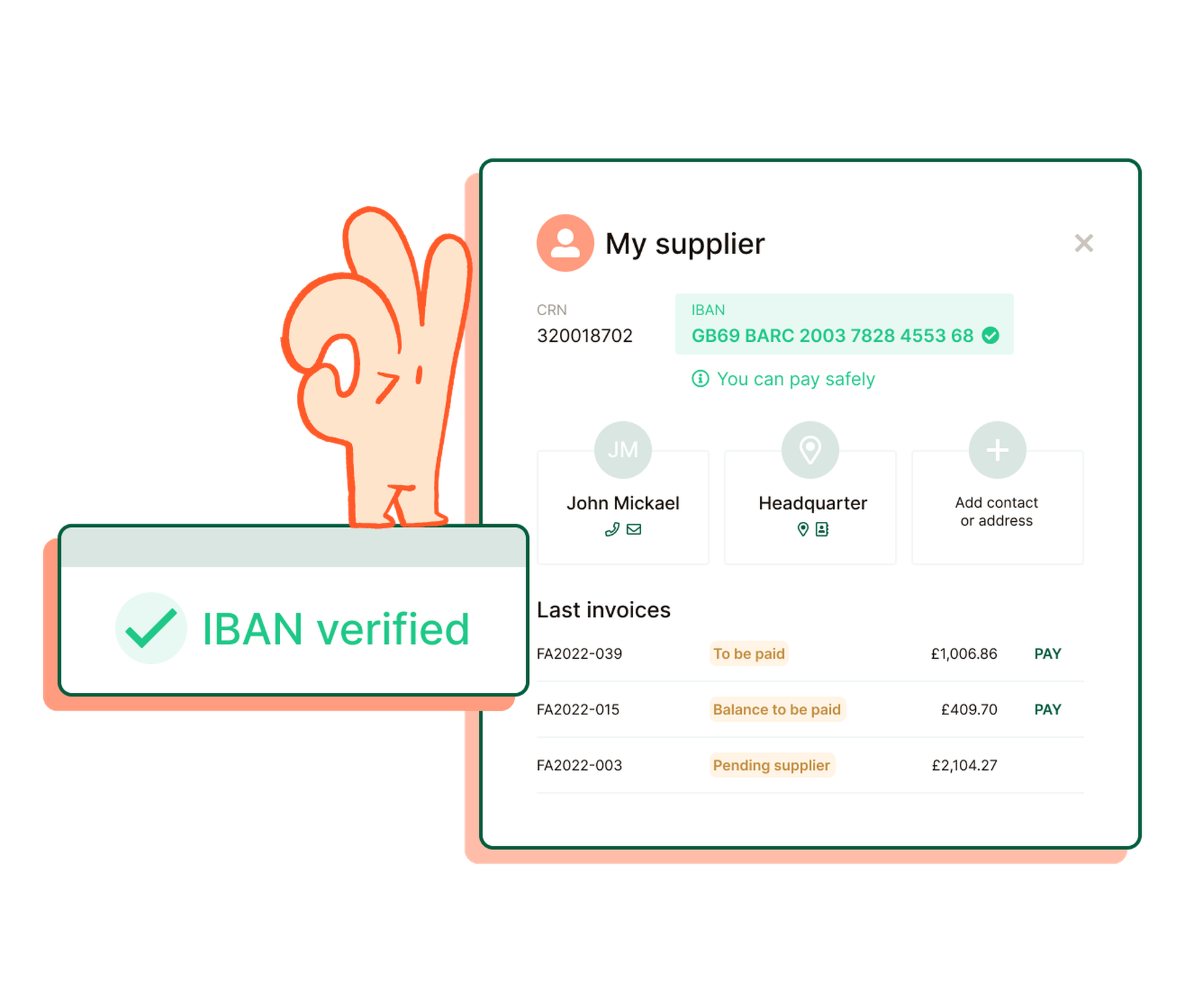

By eliminating the need to print documents, Libeo reduces the associated security risks. By matching bank details to the invoices and flagging when these change so they can be reviewed you have a reduced level of risk.

Pay with confidence

Our secure network automatically checks suppliers' bank account details to protect you from fraud.

Get a demoLibeo, la solution de gestion

des dépenses pros

Automatisez vos règlements fournisseurs, contrôlez votre cash et optimisez enfin vos marges.