Summary

Libeo, la solution de gestion

des dépenses pros

Automatisez vos règlements fournisseurs, contrôlez votre cash et optimisez enfin vos marges.

What is Workflow Automation? PRACTICAL EXAMPLES

Automation is something we’re all familiar with in our daily lives — from self-checkout lanes at grocery stores to automated voice-response systems on customer service phone lines. Workflow automation is the act of automating repetitive and routine tasks in a workplace. It is designed to eliminate unnecessary steps in an existing process, which ultimately improves the overall quality of the results.

The basic idea is that you create a set of instructions for how to handle a task, then have the system execute those instructions without any further intervention from you. If you’ve ever used an online form that automatically sends an email to someone once you complete the form, this is workflow automation.

But what exactly does it mean for accounting software?

workflow automation: examples

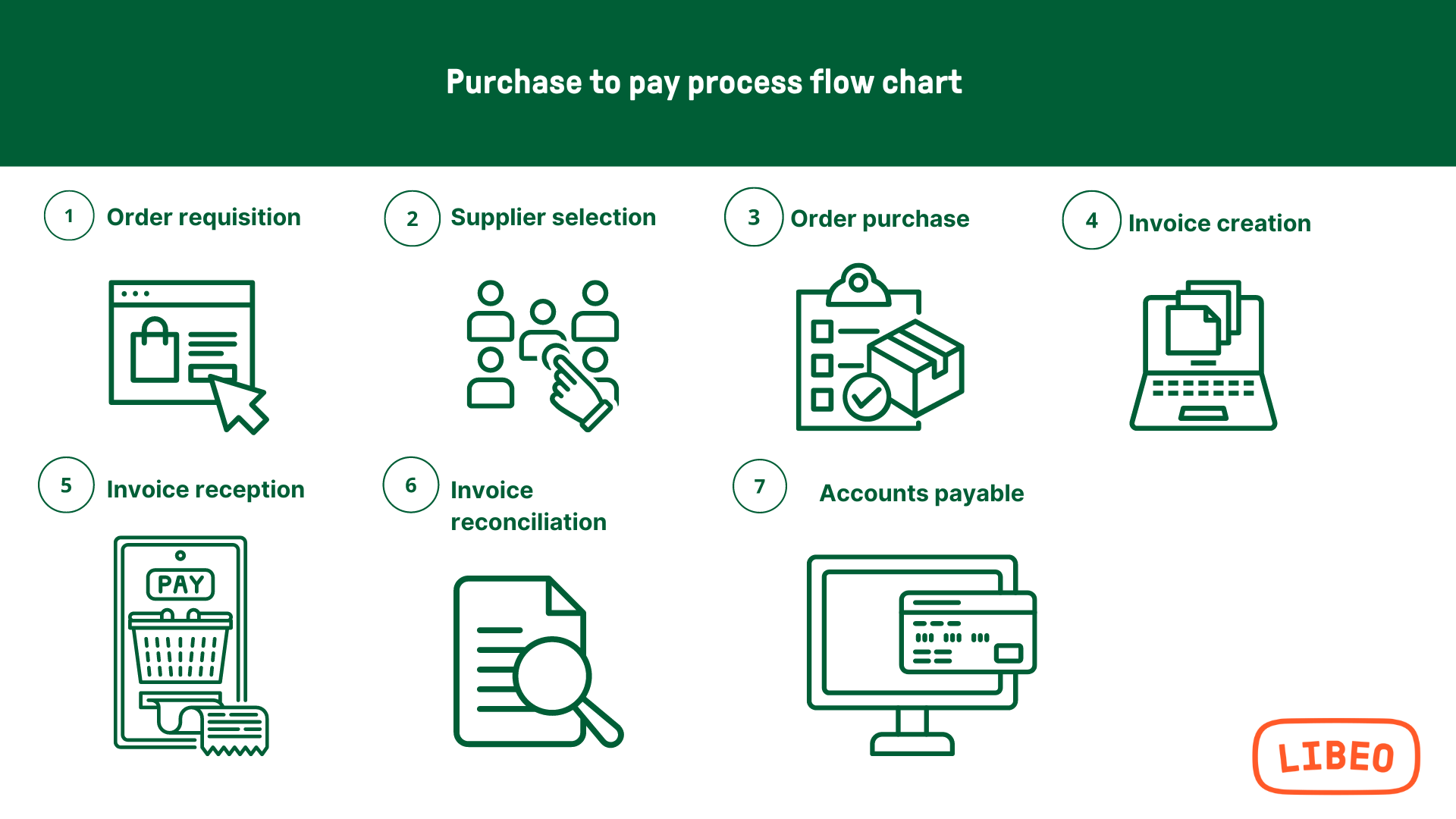

Workflow automation is used in payment approval processes to streamline invoices validation from reception to payment approval. The automation rules set up in the system make it possible to automatically validate the steps according to the origin, the amount or the payment method of the invoice:

Why Integrate Workflow Automation Into Your Firm?

Roughly 75% of accounting tasks can be automated with accounting software. Accountants use workflow automation tools to save time and improve their efficiency, so they can spend more time on high-value activities such as performing audits and analyzing financial data.

1. Automation helps improve productivity

According to a survey entitled The Practice of Now conducted by Sage in 2019 and 2020, 58% of accounting professionals are expected to be automating accounting tasks using artificial intelligence (AI) solutions within the next 3 years. 58% said updating technology has improved efficiency and productivity - vital for creating space for adding service offerings clients demand and 91% said technology allows them to focus on their clients or simply be more productive.

2. Workflow automation helps with consistency

One of the most important aspects of workflow automation is consistency. When your clients expect the same level of service from month to month, year after year, you need to make sure that your firm's workflow isn't changing from one day to the next.

Accounting firms often run into problems when they fail to implement an effective workflow automation system into their organization. A lack of consistency can cause scope creep — this refers to when additional tasks are added over time without properly planning out how they fit into a larger project plan. This can lead to increased costs and lower quality work overall.

3. Workflow automation improves accuracy

Accounting firms are often the first stop for businesses who need a financial audit or other accounting-related services. This makes them an important part of a business' operations, but it also means that they have to juggle an enormous amount of data.

The companies that use these accounting firms rely on them to be accurate, so any mistakes or errors in their work can be costly. Many firms rely on technologies such as Optical Character Recognition (OCR) and dematerialization for keep everything running as smoothly as possible and automate their workflow processes.

4. Automation can help you reduce errors while also reducing costs

Batch processing allows admins to perform multiple tasks in one go rather than performing them individually. If you have multiple clients with similar requirements (such as invoicing), batch processing is a great way of reducing errors and saving time.

For example, if one client has 10 invoices due on the 25th of each month, using batch processing means that all 10 invoices could be generated at once rather than having to create each one separately and then sending them out individually via

5. Automation helps you stay compliant with regulations

With the growing complexity of accounting processes and the increasing number of regulatory requirements, it is becoming more difficult for accountants to handle their workload. This leads to increased costs for accounting firms as well as their clients.

According to the Accounting Today 2022 Year Ahead Survey, 51% of firms said their biggest challenge is keeping up with regulatory change. Moreover, according to Wolters Kluwer, more than 50% of surveyed firms have struggled to keep up with legislative changes.

Interestingly, large firms actually a higher-than-average percentage of their time on compliance work, but not at the expense of advisory services — they make up the difference by spending less time on administrative work.

5 essential workflow automation solutions for accountants

Here are 5 essential workflow automation solutions for accountants:

- Automating Payments - Automated payment processing makes it easier for firms to make timely payments to vendors or other outside parties without worrying about missing deadlines because the system automatically sends out payments as soon as they're due.

- Automating Invoices - Invoice processing is a critical part of the accounting workflow. Accounting firms must send out invoices in a timely manner to ensure their clients receive payment on time. Many accounting firms use automated systems to send out invoices, which helps them keep track of outstanding balances and manage cash flow more effectively.

- Automate Client Reporting & Statements provides a single platform for practices to build a complete client management system. It saves time on generating client reports based on specific criteria and connects data from multiple sources.

- Automating Expenses et Reimbursments - Accountants are often left with the time-consuming, tedious and error-prone task of manually entering and reconciling expenses. With automation, this isn't an issue since everything gets entered automatically based on your preferences set up in the software. Accountants also use it to automatically generate receipts when someone submits an expense report through QuickBooks Online or Xero.

- Automating Data entry - Manual data entry can be prone to errors since there is always room for human error when entering information manually. By automating this process, you can reduce the risk of errors occurring by eliminating manual input altogether.

Looking for an example of workflow automation tool that includes the automations listed above? Libeo is a fully integrated and automated business-to-business payments platform, bridging the gap between invoices, payments, reconciliation and accounting.

Focus on higher-value work

Approve and pay invoices in seconds without entering your suppliers' bank account details or using your banking app.

Get a demoFAQ

What is workflow automation in CRM?

By using workflow automation software, such as Salesforce, account managers can set up reminders and processes to let clients know about payment due dates or service expirations. Automated renewal and address update processes can increase customer satisfaction and save time for both account managers and clients.

What is data workflow automation?

A data workflow is a set of processes that moves data through business systems and data-storage solutions such as Microsoft Azure. It often relies on forms and documents to move the data from one step to the next.

What is the best workflow automation software?

There is no answer to that question. When setting up workflow automation, companies must first consider their needs and goals. Once these are defined, they can look for a tool that will help them achieve those goals.

Libeo, la solution de gestion

des dépenses pros

Automatisez vos règlements fournisseurs, contrôlez votre cash et optimisez enfin vos marges.