Summary

Libeo, la solution de gestion

des dépenses pros

Automatisez vos règlements fournisseurs, contrôlez votre cash et optimisez enfin vos marges.

What Is Optical Character Recognition?

Optical Character Recognition (OCR) is a type of software that is used to convert images into editable text. It is commonly used for scanning and converting printed documents, such as contracts, letters, forms and checks into editable files. OCR software can be used on both desktop computers or mobile devices such as smartphones and tablets.

Where is OCR commonly used?

OCR technology has been around since the early 1900s when it was first used by libraries to index their books. Today, OCR technology is used in many different industries including law enforcement, banking, healthcare and retail. The most common use of OCR technology is to scan documents so that they can be stored electronically for future use or converted into searchable PDFs for easy access.

What is an example of OCR?

Optical character recognition (OCR) is the process of scanning a document, photograph, or other image and interpreting the meaning of the content. The technology can scan printed text and convert it into editable text on a computer. This makes OCR a powerful tool for converting documents into editable digital content.

Don't look for your invoices any more!

Take a picture of your invoices, store them on your Libeo space and find them all in one place

Book a demoHow Does OCR Work?

Essentially, OCR uses machine learning to recognize characters. The process involves taking an image and feeding it into an algorithm that analyzes the pixels in order to identify the letterforms. Once identified, the resulting text can be edited or copied into other applications.

There are two different types of OCR software available: desktop and mobile.

- Desktop OCR software is installed on your computer and requires a scanner or camera to capture an image of your document.

- Mobile OCR software works on smartphones and tablets by allowing users to take pictures of their documents with their device's camera then converting them into text-based files immediately after taking the picture.

What Can We Do With OCR?

There are many ways to use OCR software:

- Scan documents and save them as PDFs or images with searchable text

- Process invoices using optical character recognition software

- Extract data from reports, books and other printed material

One of the major challenges in accounting is the accurate transcription of entries into the accounting software. OCR is there to reduce or even eliminate the need for manual entry of documents, and thus avoid the most common accounting errors:

- Inversion or reversal of figures;

- Omission of carry-over of an item.

- Double carry forward of the same item.

- Interversion between debit and credit when carrying forward an item.

- Double recording of the same invoice in the software

To avoid this, it is advisable to use an automatic invoice collection solution with integrated OCR, to automate data entry while limiting human intervention.

Automate data entry with libeo

Libeo's Accounting Automation solution is a flexible and customizable solution aimed at reducing your business's manual data entry, improving cash flow, minimizing manual errors and speeding up the process of bill payments. Libeo's AP automation solution includes the following features:

- Automated invoice separation

- Approval processes

- Document imaging, data capture, and extraction

- Pre-packaged workflows

- Bulk payment

- Data export

- Optical character recognition (OCR)

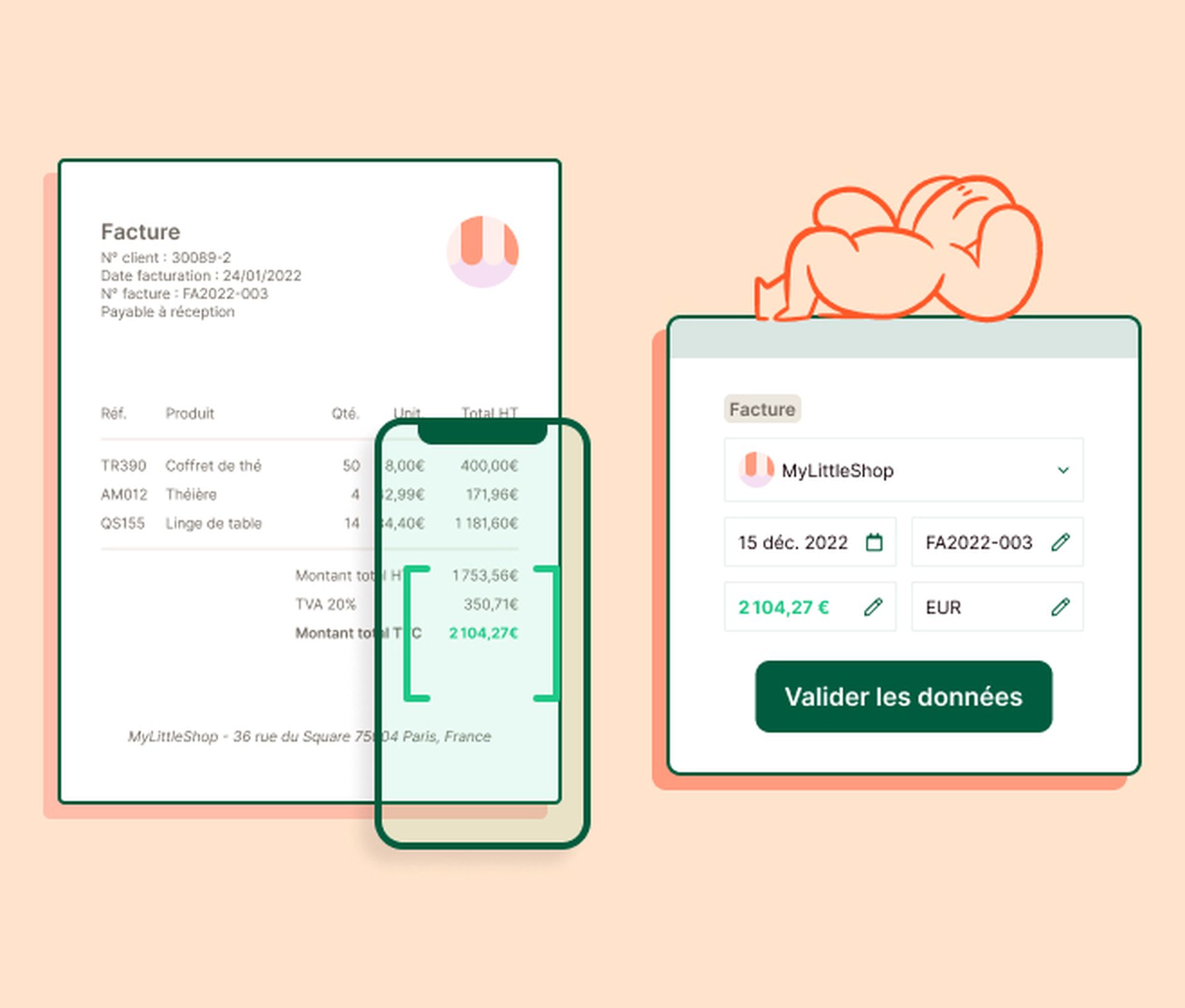

Libeo's OCR directly captures printed or handwritten data in the management tool. Libeo's optical character recognition algorithm is designed to detect duplicate invoices.

With the automatic recovery of your supplier invoices via web collectors, you centralise all your accounting documents on a single platform. As soon as you receive them, the software will extract the data from your invoices:

- Invoicing date,

- Supplier ID,

- Invoice number,

- VAT number,

- Currency,

- Amount including and excluding VAT, etc.

Every invoice imported in Libeo is screened to check the information before validation.

All you have to do is validate the import and schedule the payment. By centralising your invoices, not only do you simplify the monitoring of your accounts, but you also save an average of 10 hours per week on processing the invoices received and managing your cash flow.

Capucine Frerejean, Co-founder of The Cali Sister

"Compared to before Libeo, we’ve reduced the amount of time we spend on collecting, paying and analysing supplier invoices by two thirds!"

Learn moreLibeo, la solution de gestion

des dépenses pros

Automatisez vos règlements fournisseurs, contrôlez votre cash et optimisez enfin vos marges.